The Future of Startups 2013-2017, beginning of a series...

Marc Andreesen gave a great interview about a year agi about “The Future of the Enterprise” and where the next startups will be playing – Hadoop, Big Data, BYOD, etc. He mentions about 10 companies he’s involved in – let’s see what’s happened in the past year with them.

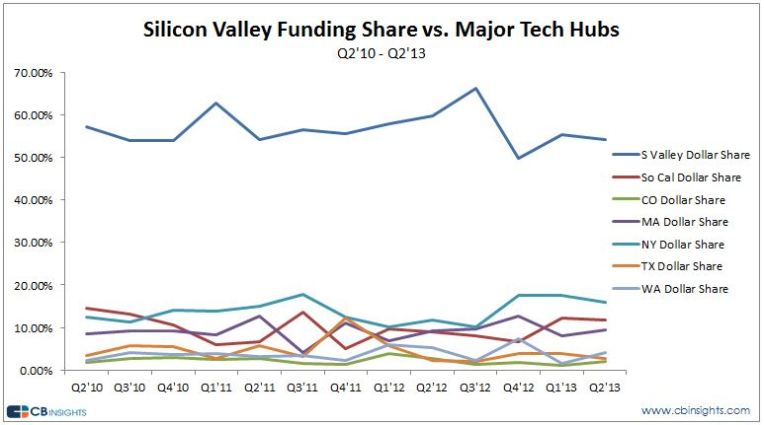

These are good things to think about and companies to study as we move back from consumer to Enterprise in the tech cycle. Security, Cloud, NoSQL databases, etc. are all precursors, rumbles before the big boom. Hundreds of startups will succeed in this world over the next few years, like all the mobile app companies over the past 5 years. Some of these next big startups are in L.A., but most are coalescing around the Palo Alto – San Mateo – San Francisco center of the universe.

Also, yesterday the winner of the latest Crunchies was GitHub and #2 was Palantir, both non-consumer, big data organizer companies. So jump on this next rain now, more postings on this to come. @tomnora

Marc Andreessen On The Future Of Enterprise

ALEXIA TSOTSIS

Sunday, January 27th, 2013

Comments

In doing research for a post on “The Enterprise Cool Kids” at the tail end of last year, I interviewed Silicon Valley veteran Marc Andreessen about where he thought the enterprise was headed.

While excerpts of that interview made it into the post, the transcript of the entire interview was so good it deserved to be published in its entirety.

************************

Alexia Tsotsis: Since people like me (millennials) are putting pressure on our IT departments to buy products that we can actually use and aren’t blinded by, what do you think the enterprise space will look like in the next five years?

Marc Andreessen: Yeah. So let me maybe start with sort of – top-down and bottoms-up is how we think about it, because both are important — so let me start with historical context and then maybe go to the stuff happening right now. Is that all set?

Alexia Tsotsis: Yeah, it’s perfect.

Marc Andreessen: So the computer industry started in 1950 and basically ran for 50 years with the same model, which was a model where all of the new computers, all the new technology, all the new software started out being sold for the highest prices to the biggest organizations.

So originally the customer was the Department of Defense. It was the first customer for the computer. In fact, one of the big first computers was called SAGE, which was a missile defense, the first missile-defense computer, which was like one of the first computers in the history of the world which got sold to the Department of Defense for, I don’t know, tens and tens of millions of dollars at the time. Maybe hundreds of millions of dollars in current dollars.

And then five years later computers became — they dropped half in price and then the big insurance companies could buy them, and that’s when Thomas Watson, who ran IBM at the time, was quoted as saying, “There’s only a market need in the world for five computers.”

The reason that wasn’t crazy when he said it is because there were only five organizations that were big enough to buy a computer. So that’s how it started. And then IBM came along and productized the mainframe, and then all of a sudden big normal companies — manufacturing companies and banks — could start to buy computers. And then DEC came along and came out with the minicomputer, and then all of a sudden smaller companies could start to buy computers. And then the PC came out and then all of a sudden individuals could start to buy computers. But the PC only ever got to hundreds of millions of people. It never got to billions of people.

Now, the smartphone has come out and it can get to billions of people.

And so it has always been this kind of trickle-down model for 50 years. We think that basically about 10 years ago the model flipped. And so we think that the model flipped to a model where, today, where the most interesting and advanced new technology now comes out for the consumer first. And then small businesses start to use it. And then medium-size businesses start to use it, and then large businesses start to use it, and then eventually the government starts to use it. But this is a complete change from the way it has always worked.

Alexia Tsotsis: It’s grassroots versus trickle-down.

Marc Andreessen: Versus trickle-down. And the reason is because – the reason fundamentally is because now that you have got these things, you have — now that you have a computer in everybody’s hand, all of a sudden all these barriers — it used to be these barriers to market entry were so big, it used to be there just weren’t that many early adopters in the world. To bring out a new technology for consumers first, you just had a very long road to go down to try to find people who actually would pay money for something.

And now all of a sudden you have got this global market of all these early adopters that have smartphones connected to the Internet, and they can just pick up their things and run with them.

And of course consumers can make buying decisions much more quickly than businesses can, because for the consumer, they either like it or they don’t, whereas businesses have to go through these long and involved processes.

So that’s the big, big, big change that’s happened. And that’s been reflected in the entrepreneurial community, where entrepreneurs, especially between 2000 and 2008, entrepreneurs really only wanted to do — for the most part wanted to do consumer software, because that’s the only software that they could actually get anybody to adopt. It became very hard to get businesses to adopt new stuff.

In the last five years, there’s been this sort of acknowledgment of the consumerization of the enterprise, which is consumer product development, design methods applied to business software, of which SaaS and cloud and all these things are examples. Salesforce.com, Evernote is an example. So now you have got the rise of this new set of companies that are sort of consumerized technology for businesses.

Then from a bottoms-up standpoint what you said is exactly right, I think, which is that the new generation of employees grew up on smartphones and tablets and touch and everything, social networking and Twitter and everything else. And so if you take a typical mainframe or, even these days, PC-based system and you give it to a 22-year-old college graduate, it’s like beaming in products out of the Stone Age. Why would you do that? Why would you force people to use all this old stuff?

And then that leads to the big thing that’s starting to happen right now, which is this “Bring Your Own Device” movement, where more and more companies are saying, well, basically, if I have to support smartphones and tablets anyway, and my CFO is probably carrying around an iPad and all my new employees are coming in with iPhones, so I have already got to support this stuff, so then I might as well encourage it.

And I might as well basically have a model where instead of issuing a company laptop to everybody or even a company phone, why don’t I just let people bring in whatever device they want and just plug-in and access it.

And then they get all excited, because then they say, well, not only are my employees going to be happier and more productive, but then I don’t have to buy them hardware anymore, so I can cut my budget. So that’s the big thing that’s starting to happen right now.

Alexia Tsotsis: So how does it affect the way people are building? I have about five companies that have made this list. Some of them are yours — Okta, which is big on the Bring Your Own Device thing, because you are logging in through Okta. Okta, Cloudera, Box, GitHub, Zendesk, and Asana. Are there any that I have missed?

Marc Andreessen: We just invested in this company called ItsOn, that we announced yesterday.

Alexia Tsotsis: Oh, the mobile –

Marc Andreessen: The mobile billing. The advantage — the thing that that’s going to be able to do is do split billing in a new way, between the business and the consumer. So on a single device you will be able to cleanly build data usage by application. So your employer can pay for your Salesforce.com and your Workday data usage on your phone and you get to pay for your Facebook and your Hulu usage. So that will be another enabler for a lot more of the Bring Your Own Device stuff.

Marc Andreessen: We have a bunch of stealth investments. I mean, this is a big, big thing — big change for us, so we have a bunch of stealth investments — I mean, companies that haven’t talked about what they are doing yet.

Who else? I mean, there is a bunch, who else should we have –

Alexia Tsotsis: Platfora.

Marc Andreessen: What’s that, Platfora? Yeah, Platfora is the actual user interface layer on top of Hadoop. So sort of Platfora and Cloudera kind of go hand in hand.

Actually — we have another one actually that is — well, it sounds esoteric, but it actually is very relevant. We have a company called Tidemark, which is in a category. It’s called Enterprise Performance Management, which is kind of a weird term. It’s basically large-scale financial planning and analysis for big companies.

The significance is it has a — I believe it only — I don’t know if it only or primarily, but I think it only has an iPad UI. So it’s the first complex financial system for big companies, where the assumption is that the user is on an iPad.

That’s a really big deal, because that category of software, line managers and businesses have never actually used that software themselves. Instead they employ analysts to use the software who become highly trained on the software.

By putting the iPad UI all of a sudden you can have anybody in the business have access to all the financial analysis and planning. Even in a very deep sort of sector of enterprise software where most people would never see it, this change is having a big impact.

What else? Asana you mentioned.

Alexia Tsotsis: Asana, Box, Zendesk, these are the companies that I am assuming I will be using four years from now to run my business.

Marc Andreessen: Yeah, exactly! Exactly right! Then of course Workday, of course, Salesforce.com, of course NetSuite, 37signals. We probably have three or four others in our portfolio that I am blanking on, but yeah, this is sort of the — and then by the way, the corresponding thing is that a lot of this is on how you run a business and then how you do marketing, of course; AdWords and Facebook and Twitter, all these systems and then all the enabling systems for that; so HootSuite and Marketo and –

Alexia Tsotsis: GoodData.

Marc Andreessen: Oh, another one, GoodData. So GoodData is at the intersection of kind of marketing and business. So GoodData is an actual easy-to-use analytics package. It’s sort of like a supercharged version of Excel that lets you suck in data, you can suck in all your Facebook advertising campaigns, you can suck in all your Salesforce.com data, and you can run — you can actually, yourself, as a small business person, actually analyze and find friends and data.

Alexia Tsotsis: I have heard good things about them and they just sent us a guest post.

Marc Andreessen: They are very good. So then you add up all these companies and you are like, “Well, okay, so number one, they are all basically new companies. I think who is not on that list are all the existing companies that sell business software.”

Alexia Tsotsis: SAP, Oracle … I mean I wrote a post about this that was supremely misunderstood and then today SAP came out with SAP Jam, which is a competitor to Yammer and to Salesforce, but it’s their own socialized CRM, like HR management software. I worry about this because it’s not going to work. You can’t fight the future.

Marc Andreessen: Oh, right, right, right. I mean, the joke about SAP has always been, it’s making 50s German manufacturing methodology, implemented in 1960s software technology, delivered to 1970-style manufacturing organizations, like it’s really — yeah, the incumbency — they are still the lingering hangover from the dot-com crash.

So a lot of incumbent business software companies did what a lot of big companies actually did and other industries, media companies after the dot-com crash, which is they said, “Oh, thank God we don’t have to worry about this Internet thing. It’s over. Stick a fork in it. It’s not going to be a big deal.” And then it turned out that it actually wasn’t over, and they still haven’t adjusted.

Alexia Tsotsis: Yes, and we are watching that now. And so the other reason that I am very interested in delving deep into this space is that it seems like IPOs like Workday, Palo Alto Networks are sort of — they have metrics and analytics that Wall Street understands, more so than a Facebook; like “We are going to sell X number of this in the next year.” So it would seem like they are an antidote to, or at least less offensive than, social/consumer Internet companies are to the public markets.

Marc Andreessen: For now. The whole market goes back and forth in whether they prefer enterprise businesses or consumer businesses. The argument in favor of consumer businesses is you don’t have these crazy end of quarters like when the IT purchasing manager doesn’t buy the product and the company misses the whole quarter.

The advantage of the consumer businesses is they tend to be much broader-based, much larger number of customers, that tend to over time be a lot more predictable. The advantage of the enterprise companies is they are not as subject to consumer trend, fad, behavior.

But I would say the market is schizophrenic. So right now we are in an era where the market wants enterprise companies. I am just saying like wait a year, that will flip again; wait another year after that, that will flip again.

It’s sort of the picks and shovels thing. Like everybody — it’s like the consumer businesses get really hot and then everybody realizes that there is lots of competition and that those models have — they are complicated businesses and they have their issues, and then everybody gets all excited about picks and shovels.

And everybody rediscovers the picks and shovels analogy and says, ” Oh, the Gold Rush in California, the people that made all the money were the guys who were selling picks and shovels to the prospectors.” And then people realize the picks and shovels business is really hard, and then everybody says, “Oh, we should invest in the consumer company because they” — so it’s just –

Alexia Tsotsis: It’s cyclical.

Marc Andreessen: It’s cyclical. It’s deeply cyclical. But we are in an environment right now, to your point, where there has been huge rotation out of the consumer companies into the enterprise companies.

Alexia Tsotsis: It seems like the consumer market is starting to cool — I mean, not starting, but the signaling is there.

Marc Andreessen: Yeah. It’s unpredictable. All you need is for one of the new enterprise companies to completely whiff a quarter and their stock will collapse and then everybody will get all freaked out. I mean, it’s just a continuous — the reality is every single business is hard.

Alexia Tsotsis: I love this.

Marc Andreessen: There are no easy businesses in the world other than maybe Google, but other than that, there is no easy business anywhere in the world. So what happens is Wall Street gets enamored by the businesses that look like they are easy, until it turns out that they are not, and then Wall Street gets disillusioned and freaked out, and then rotates into the businesses that they think are going to be easy, and then they get endless disappointment. It’s like a seventh or eighth marriage at some point.

At some point the problem isn’t with your seventh wife. At some point the problem is with you.

Alexia Tsotsis: Is the solution “keep calm and carry on,” or what is the solution to this?

Marc Andreessen: There is no solution; it’s a permanent state of affairs. So this is a big part of what actually we do. A big part of why venture capital actually is important and enduring is because the public market is flighty and late-stage investors are flighty, and customers for that matter are flighty, and so you can’t — if you are running one of these companies you can’t — you just can’t rely on people being balanced. They are just not going to be.

And so you have to have a level of determination to just stick through the good times and the bad times. And you need to have investors at the core of your company who are going to support you through that.

The big advantage that we have as a venture capital firm over a hedge fund or a mutual fund is we have a 13-year lockup on our money. And so enterprise can go in and out of fashion four different times, and we can go and invest in one of these companies, and it’s okay, because we can stay the course.

And then what happens is everything tends to get better, all the products tend to get better, all the companies tend to get better over time if they are working hard at it. So we are fine. Like if everything we are investing in goes out of fashion, we are not going to change anything we do, because we can’t change anything. We are already invested in these companies; we can’t sell our stock. We don’t have to sell our stock. So we just say, we will go back to work. And then at some point it really gets exciting again.

Alexia Tsotsis: I guess the trick is to be hyper-aware.

Marc Andreessen: So the big thing we try to do is be aware of the difference between the reality and the psychology, and the reality tends to progress in a certain way and then psychology tends to whip all over the place.

It was very educational for a lot of us to go through the dot-com crash, because you remember, in 2002, like there were a number of universal truths asserted in 2002; the Internet didn’t matter, consumer Internet business was dead. Larry Ellison in 2002 came out and gave a speech and said the correct model for enterprise software, enterprise computing, will last for 1,000 years.

He said all these kids that were trying all this new stuff and it didn’t work, and now we know it didn’t work, and so the model is going to be the existing IBM and Oracle for the next 1,000 years. And everybody kind of said, hmm, you know, that makes a lot of sense, like all that innovation stuff didn’t work, and so –

Alexia Tsotsis: That’s what David Sacks said.

Marc Andreessen: Exactly, this is the fact. People reach a point where they start to get a little bit too rich, maybe a little bit too old, and they start to say these things.

And then so here we sit 10 years later and we are in the middle of a complete reinvention of everything in enterprise computing, and it’s like, okay, like that’s the reality. People happen to be excited about it again at the moment. That’s great. I am happy for that. But wait two years and they will be depressed about it again, but that won’t keep it from happening. It will still happen.

Alexia Tsotsis: It’s just like the fashion industry. So because it’s heavily fashionable now, do you see it being over in a year?

Marc Andreessen: No, I don’t mean to make a specific prediction. I don’t know if it’s a year, two years, four years. Look, all of the products are going to keep getting better. All of the trends that we are talking about are going to keep continuing. Nothing is going to stop consumerization of the enterprise. Nothing is going to stop Bring Your Own Device. Nothing is going to stop Software-as-a-Service. Nothing is going to stop cloud. All those things are just going to keep going.

I am just saying people are going to be — they are all excited about them now. At some point again they will be unexcited about them and then at some point after that they will be excited about them again. So it’s hard to draw conclusions about the importance of the trends or the progress of the trends by the current level of press coverage, the current level of Wall Street enthusiasm.

Alexia Tsotsis: So beyond the press coverage, beyond the fickleness of trends, beyond the application layers — because most of those companies are just apps — what are the real opportunities you see in the enterprise stack as it stands right now?

Marc Andreessen: Well, there is a whole bunch. So there is a big thing — there are a couple of big things that are happening. So one of the really big things that’s happening is, historically the best enterprise technology was only — it’s a trickle-down thing — the best business technology was only ever available to the biggest companies.

And so if you were a Fortune 500 company with a big IT department, you had a huge advantage over a small business that was trying to compete with you, because you just had so much more budget and staff and professionals and expertise and access to all these big vendors and you could spend tens and millions of dollars on all this stuff.

So it was very easy for — in the old world it was very easy for big companies to use IT as a weapon against small companies.

The classic was Walmart versus local retailer, right? Walmart’s advantage in logistics and in pricing and in data analytics was just so great that they could kill small retailers at will.

Today all the consumerized enterprise stuff is as easily usable by the small business as it is by the large business. In fact, it’s probably more easily usable by the small business than it is by the large business, because with a small business it’s like you can just use it, like you don’t have to go through a long process, you don’t have to have a lot of meetings, you don’t have to have committees, you don’t have to have all this stuff, you can just start picking up and using it.

So the best technology for inventory management and for financial planning and for sales-force management and for online marketing can now be used just as easily or more easily by a small business. There is an opportunity here for a shift of the balance of power for big businesses to small businesses.

And then for vendors, the companies we fund, there’s an opportunity to really dramatically expand the market, because a company like Oracle, as successful as it is, it only really has about 5,000 customers that really matter worldwide. Whereas, a company like Box or a company like GitHub could have 500,000 customers or 5 million customers that really matter, and that’s a huge change.

So market expansion, small business versus big business, what else? Oh, the shift, the other big one, the shift from CAPEX to OPEX. So the shift from buying a lot of servers and databases and software licenses and networking equipment, the shift instead to just renting it all. So the shift towards cloud services.

So we don’t have — no company that we invest in anymore actually ever buys any hardware. I mean, they buy their laptops and that’s basically it. And increasingly they might not buy their laptops, because their employees will just bring their own devices. But they don’t buy servers. They don’t buy storage devices. They don’t buy any of this stuff, they just rent on AWS. And they don’t buy sales-force automation software, they rent on Salesforce.com.

And so having sort of a much lighter-touch way for businesses to be able to get funded, you just need a much smaller budget. And that’s why you see these — you see it in the startup world, you see three or four kids with laptops who are able to go do amazing things on a global scale for no money. And I think businesses are going to figure out more and more how to do that as well.

Alexia Tsotsis: Do you think that the biggest inefficiencies are at the network layer, the database layer, or the storage layer currently?

Marc Andreessen: All the above. They are all changing. I think they are all changing.

Alexia Tsotsis: What do you think about the interplay between the enterprise market becoming more efficient and the explosion of the consumer market because you don’t have to pay for something like storage?

Marc Andreessen: I don’t know, it’s sort of all intertwined. I mean it’s all — because a lot of what businesses do is then offer consumer services based on all these changes. So it’s kind of all — that’s why I say it’s kind of all happening at the same time, a lot of the same stuff.

I would say the consumer Internet companies — in a lot of ways if you go inside the consumer Internet companies and you see how they run, it’s how all their businesses are going to run. They are going to be doing all of the same kinds of things. The big businesses are just in the process of trying to figure out how to catch up.

So everything, Hadoop and scale-out architectures and cloud services, and the whole thing it’s all — and use of new technologies like Box and GitHub, the consumer Internet companies all are just built this way. And then if you go inside a big consumer product’s company or a big manufacturing company, they are all trying to figure out how to make the jump. But it’s all kind of the same stuff.

Alexia Tsotsis: So which of the big incumbents do you think are most likely to get disrupted by this new wave of the enterprise cool kids?

Marc Andreessen: Yeah, this is the part where I get into the most trouble.

Alexia Tsotsis: That’s why we save it for the end.

Marc Andreessen: Yeah, exactly! I don’t know if I am going to — let’s see, I am going to try and figure out if I am even going to answer the question.

So I would say for sure — like the systems companies, like the companies that provide hardware, the server companies and networking companies, the bad news for them is the end customers are not going to buy as much stuff; the good news is the cloud companies are buying a lot of stuff.

So for every server that’s not bought at a manufacturing company, there’s a server being bought at Amazon. So it’s a change in purchasing pattern for all the gear, but the gear is still being bought.

I think it’s at the software layer where the big disruption happens. I think it’s application software in particular and just sort of an extended infrastructure software. It’s like anything for which there is a — any piece of installed software for which there’s a web or a cloud equivalent, I think is in real trouble, and I think that’s just now becoming clear.

The other thing that’s happened is 2012 seems to be the year of the actual SaaS tipping point, like where big companies are now saying, you know what, it’s fine, like I can do it, I can do Salesforce, I can do Workday. Because there used to be lots of issues around can I trust the security issues or liability issues, and an awful lot of big companies are now saying, “You know what, I am going to save so much money, the service is going to be so much better, my users are going to be so much happier, more productive. I have got to make this stuff work on iPhones anyway, so I have got to do something new.”

“My old software vendors are charging me these huge upgrade and maintenance prices. I can switch to SaaS for less than the cost of the maintenance on the old software.” Like, at a certain point it becomes –”Oh,” and then on security it’s like, “Yeah, I may have concerns about SaaS security, but it turns out I have the concerns about my own internal security anyway.”

So every one of these companies has had an employee steal a laptop that has 25 million customer records on it, and they are like, “Well, okay, if I can’t even lock that down, then why am I that worried about whether somebody is going to break into Salesforce.com?” And by the way, Salesforce.com has gotten much better at security.

So there is a bunch of new technologies coming out that are going to make cloud and SaaS even more secure, and I think are going to end up making — I think cloud and SaaS are going to end up being a lot more secure than anything inside the firewall. So that’s the other thing that’s about to happen.

Alexia Tsotsis: So which enterprise companies are doing their best to adapt to just this tidal wave of trends and which ones are just completely failing?

Marc Andreessen: The problem is I have conflicts on this issue, because I am on the HP board in particular, so I can’t really — unfortunately I am kind of gagged on the topic of the big companies.

Alexia Tsotsis: Are you happy with how HP is doing?

Marc Andreessen: This is exactly what I can’t talk about. I just can’t talk about it. So the problem is I can’t talk about HP and I can’t talk about HP’s competitors, so it’s just a no-fly zone for me.

Alexia Tsotsis: I respect that.

Marc Andreessen: So I have to stick to the startups.

Alexia Tsotsis: Let’s see, what about other companies that aren’t in your portfolio?

Marc Andreessen: Although I have a lot of opinions. You mean startups?

Alexia Tsotsis: What about startups that aren’t in your portfolio, because you said that only 10, 15 companies a year are responsible for 97 percent of the returns. Which enterprise companies that aren’t in your portfolio are you interested in?

Marc Andreessen: So let’s see, there is this category of kind of outsourced work.

Alexia Tsotsis: TaskRabbit.

Marc Andreessen: Well, there’s TaskRabbit and Zaarly and companies like that on the consumer side; and then on the business side there’s eLance and oDesk and RentACoder. So these companies that are kind of for — in the sort of mechanical term, distributed workforces and outsource work being run online.

So like oDesk, oDesk you can actually have remote contractors working on a project, and one of the features is that it actually takes snapshots of their screen every five minutes. You can see if — anybody who actually manages anybody, number one that sounds spooky, but number two, “Wow, that sounds great, like, I sure wish I can do that.”

So there is sort of the whole category of an outsourced workforce that sort of — it goes back to what you said about the employees is, you will have — it feels a lot like in the new economy you will have a lot more contractors. You will have a lot more people with sort of fluid careers contracting on a project basis, and then all this technology is going to be an enabling layer for that.

So anybody on their laptop, anywhere in the world, being able to tap in and be able to get work and do work, whether it’s for small companies or big companies like that. There is a whole layer of software there. We haven’t seen anybody really punch through on that yet, but I am very fascinated by it. We haven’t made an investment there yet. That’s one layer.

Let me think, what else haven’t we done? I mean, Cloudera is I think a good — we haven’t actually done an investment at that. We haven’t done an investment at the Hadoop layer. We have done — Platfora is our investment, which is the intelligence layer above Hadoop, but Cloudera definitely deserves to be on the list.

Zendesk and kind of its generation of companies are definitely for real, or so it appears.

What else? We have been pretty active. I mean, we have been trying to take down mostly good companies. We haven’t done anything yet with this whole category of marketing, the new marketing software so like Marketo and HootSuite and companies like that, we haven’t really done anything yet, but that’s a big deal.

It’s sort of like — if you are starting a new company it’s so obvious that you would want to do most of your marketing on Google and Facebook and Twitter, whereas a lot of the existing companies still haven’t wrapped their heads around that.

Education — there is actually going to be more and more. So actually companies are going to get a lot more interested in education for two reasons.

Number one is, a lot of companies need to actually educate their customers or their partners, and a lot of that has to happen online.

And then the other thing is companies are having — if you talk to anybody running a company, they are having real trouble hiring enough qualified people. So companies are going to have to take a more direct role in educating the candidates or educating their current employees.

So the sort of model of employees just show up and they are either educated or they are not is not working very well. There’s lots of mismatches. It’s one of the reasons unemployment is running as high as it is, is people just don’t have the skills they need for the jobs.

So I think employers are going to have to get a lot more actively involved in making sure that the supply of candidates is actually educated and that they can hire somebody who doesn’t yet know what they need to know and actually educate and train them, and a lot of that is going to happen with the new technology.

So we have this company Udacity as an example, that’s going to be, I think, important in all of that.

Alexia Tsotsis: I think the model there is if someone shows up and they have got 80 percent of the skills.

Marc Andreessen: Yeah, let’s teach them — right, exactly, the employer says let’s teach them the other 20 percent. And it’s like, well, instead of literally sending them to college, which presumably didn’t work the first time around or whatever, let’s just go ahead and provide them with the online training. Let’s set them up with their tablet at home with high-definition video. They can develop their remaining skills, or be able to retrain people once they are in the jobs.

The other is there is this real issue, like for some people it feels great to never be tied to a specific employer and to always be doing contract work and be changing jobs every two years, and it feels like it’s fun and exciting and exhilarating. For a lot of people that’s really scary. And so the lifetime employment promise that the big companies used to be able to make was very compelling for a lot of people because it felt safe.

So now you are in a world where the big companies can’t deliver — even if they wanted to deliver on lifetime employment, they can’t, and so then they have got sort of two choices.

One is, do they start to basically be a lot rougher with their — they start to do a lot more layoffs, a lot more restructurings. I remember IBM — I don’t think IBM had a layoff for 50 years. And I was actually at IBM — I was an intern at IBM when they were ramping up for their first layoff I think they had ever done, and, like, the level of freak out in the company was beyond belief. And people had no idea what to do if they got laid off from IBM. And it turns out their skills weren’t actually very useful to work for any other company, because IBM was so unique in how it ran.

So I think the companies have a real question about how do they develop their workforces, how do they make sure that their employees stay relevant for the purpose of staying inside a company for a longer period of time? And then how do you get the workforce over time to be a lot more flexible and adaptable, so that if you have to layoff a ton of people, or if you have to get out of a line of business, or if you have to expand into a new business, how do you get your current employees to adapt better to that?

Alexia Tsotsis: Do you think that’s the most ripe-for-disruption area in the enterprise currently?

Marc Andreessen: I don’t know if it’s the most, but it’s a big issue for every company. It’s a big issue for companies, because companies have hundreds and thousands of employees, it’s like, yeah.

Alexia Tsotsis: What are the top three issues that startups don’t exist for yet, because that sounds like one that a startup doesn’t exist for …

Marc Andreessen: Sort of. Education is a big component of it, yeah, it’s possible, it’s possible. I don’t know. We will wait for the entrepreneurs to answer that question.

Alexia Tsotsis: Probably the biggest enterprise cool kid is GitHub?

Marc Andreessen: They are a big one, yeah.

Alexia Tsotsis: And you made a major investment?

Marc Andreessen: Yeah. We think it’s the largest investment ever done.

Alexia Tsotsis: How did you convince them to take your money?

Marc Andreessen: That’s the key thing. So they were beating off venture capitalists with a stick. So they actually — I don’t know if you remember this, they used to have on their website, they used to say — they had four metrics that they would put on their website. They had, I think, it was number of users, number of projects, number of code check-ins, and amount of venture capital that they had raised, and that final number was always zero, and they were really proud of that.

The GitHub guys did an amazing job. It’s very rare actually to find a main — it’s very rare to find an important company that never raised any money. It’s very rare that they actually successfully bootstrapped, because it’s just so hard to do if you can’t invest any money.

So what they did was incredibly impressive. They reached a point though where they decided that they had the opportunity to become a very big and important company. And again, I would say there was a top-down and a bottom-up reason for that.

The top-down reason was they are the place, we think, and they believe, they are the place where all the software code wants to live. They are the place where all the open source code increasingly lives. All other code increasingly uses a ton of open source code. And so all the software basically wants to be in the same place, and it wants to be in the place where all the open source software is.

So they have an opportunity to be the main company that provides the systems for developing software, number one, which is just a very big opportunity, and they really decided to go for it, and that requires investment on their part.

And then the bottom-up reason was because they have enterprise customers lining up, like they have enterprise customers bombarding them with interest in buying services on GitHub. And they did not have — at the time we invested they didn’t yet have any sort of sales or marketing kind of motion to be able to do it on. They didn’t have a Salesforce, they didn’t have the sort of pricing plans — the whole thing to be able to do that — and we have a lot of experience with that.

Alexia Tsotsis: So who are the enterprise companies and do they have –

Marc Andreessen: Tons, it’s like the who’s who. I mean, they gave us access. One of the things they did in the diligence process was they gave us access to the email box that had all the incoming messages from all the CIOs and purchasing managers and all these big companies. And it’s literally like, “Hi! I am from big bank X and we already have like 600 people on GitHub and we want to buy an enterprise license. Who do we call and where do we send the check?” And they just had the email queue up this, and they didn’t have — they weren’t — like it’s just sitting there.

And so we are working with them to help them build out the sales and marketing capability to be able to really go get all that business.

Alexia Tsotsis: And that’s how it will make a billion dollars a year?

Marc Andreessen: Yeah, yeah. Well, I don’t know, we will see how. I mean, aspirationally, yes. It should be a very big business. Historically companies in that market have been very successful. Big one, Rational is a big company that IBM bought a while back that’s in the same market.

And then even companies, Mercury Interactive was a big company that HP bought that was in a similar kind of market. And then in the old days you had companies like Borland and Lotus that were very big in these markets. So this is sort of the new version of all that. So if it works it should be very — I mean, it’s working, so it should be very big.

Alexia Tsotsis: So we are watching the collapse of Zynga and Groupon and LivingSocial in the consumer space. Where is the bloodbath going to be, if there is one, in the enterprise space?

Marc Andreessen: I don’t know. Probably in the second and third tier. I mean, usually when you have a funding boom, categories usually get overfunded.

So probably it’s in the second- and third-tier competitors. We actually get yelled at for this a lot, but we really believe it. So the big technology markets actually tend to be winner take all. There is this presumption — in normal markets you can have Pepsi and Coke. In technology markets in the long run you tend to only have one, or rather the number one company in — the number one company in any consumer products — cars, the number one company in cars is, I don’t know, Toyota or whoever it is.

Alexia Tsotsis: I think it’s Toyota.

Marc Andreessen: Fifteen percent or 18 percent market share. The number one soft drink has only 60 percent versus Pepsi, but like what is Coke as a percentage of all drinks, it’s, I don’t know, maybe 10 percent.

The big companies, though, in technology tend to have 90 percent market share. So we think that generally these are winner-take-all markets. Generally, number one is going to get like 90 percent of the profits. Number two is going to get like 10 percent of the profits, and numbers three through 10 are going to get nothing.

And the problem is, of course, there is too much venture capital, and so companies three through 10 still get funded. So there are probably lots of sort of second- and third-tier companies that are getting funded right now that won’t succeed, but that won’t have anything to do with whether or not the winner succeeds.

Alexia Tsotsis: Which is all the venture capitalists –

Marc Andreessen: Well, the venture capitalists who are successful in investing in the winners will be very happy with this. The venture capitalists who are investing in the losers will be very sad. But everybody will get freed, because at some point there will be a bunch of companies — a bunch of startups that will go bankrupt, and then everybody will say, that must mean the whole sector is going down.

I just think people get confused. People get confused about — it’s really funny watching the stock. Like the stock market does this all the time. It’s like one Internet advertising company will have a bad quarter and the other Internet advertising companies’ stocks will all drop.

Alexia Tsotsis: It’s tethered.

Marc Andreessen: Maybe, but maybe it’s because the other ones are now taking market share away from the one that had a bad quarter. So I find the markets all have trouble processing cause and effect in the short-term and people get all confused.

Alexia Tsotsis: What is the solution to that? It’s so perplexing.

Marc Andreessen: That’s permanent. I think it’s permanent. I think it’s human nature. There are certain things that can’t be fixed, and I think that’s one of them.

Alexia Tsotsis: One would argue that the enterprise has come back into fashion, because the market is cooling on the Instagram deal being a billion dollars and now being $700 million. The market is cooling on all these photo-sharing apps and just ways to update your friends about your whereabouts.

Is the only reason the enterprise is sexy because it actually makes money and has results, or is there some overlaying tide of innovation that’s happening that’s exciting people simply because it’s culture-changing?

Marc Andreessen: I think it’s all the above. I think the changes are real. The businesses are good, which is nice. And then I think it’s also sector rotation. We talk to a lot of the big hedge funds, mutual funds. It’s really funny. We are talking about big hedge funds, mutual funds, about six months ago they all started saying, well, you know, we really think there is going to be a rotation from consumer and enterprise, and we are going to really get ahead of that. And I am like, yeah, you and 10 other guys in the last two weeks have told me the same thing. It’s like, good job, you are way out ahead on the leading edge on this.

I get to the point where I am just like — my running joke has been, it’s like little kids, like everybody out of the consumer pool, everybody into the enterprise pool. So everybody out of the waiting pool, everybody into the hot tub.

What happens when you have capital flowing in a rotation is, if all the capital starts to leave one sector and go to another sector, then all the stock prices rise in the sector that all the capital is going into, because everybody is buying those stocks.

And then everybody says, wow, look at how much those stocks are going up. We should invest in those stocks. And so the up cycle starts perpetuating.And the down cycle similarly — a lot of reasons people have been selling out of the consumer stocks is because they have been going down, because people have been selling out. So the cycle is perpetuating.

Alexia Tsotsis: So what should the smartest entrepreneur do? You have $1.2 billion to spend. Where are you spending it?

Marc Andreessen: Investing. So the smartest entrepreneurs I think generally ignore all this. We really look for the entrepreneurs who don’t pay any attention to this. We really look for the entrepreneurs who say the following, they say: “I have this really good idea and I know it’s a good idea for the following eight reasons, and I have thought about it and I have worked in the field, and I know what I am doing, and I have talked to the customers and I have figured it out, and I am going to do it. I am just going to flat-out do it. And I am going to do it whether you fund me or whether you don’t fund me or I don’t get funded. I am still going to do it.” That’s the entrepreneur we are looking for.

Sometimes that entrepreneur is in a sector that’s completely dead, and that entrepreneur is going to say, I know that everybody thinks that this sector is just dead, and in fact that’s probably why now is a good time for me to do this — is because I am not going to have very much competition.

Well, so a lot of these companies you talk about now, like Workday and GitHub and Box, got formed and funded when everybody thought enterprise was dead. Just like the consumer companies like Facebook and Twitter got funded and everybody thought the consumer stuff was dead.

So sometimes you get the entrepreneurs who are actually counter-cyclical. They are doing it precisely because nothing else is happening in that sector, and that means the big opportunities are just wide open.

On the other hand, sometimes you get the entrepreneurs who say, “I know I am doing the 36th workforce collaboration system in the consumer side; Google was the 36th search engine, and I know it’s 1999, and I know the whole sector is overfunded, but I have a better idea. I know how to do it better, I know how to do it different. I have learned from the mistakes that everybody else is making, and I am going to be the winner.”

And so we will fund either one. We fund companies in the hot sectors and we fund companies in the not-hot sectors. The only difference is the pricing, and the pricing varies basically by like 4x. But what we have just found or what we have sort of tried to learn from history is you can’t — for what we do you can’t really time the stuff. And the last thing you want to do is look at what’s happening in the public market today. And this is the thing that’s weird about how venture capital works — a lot of venture capital investments are decided based on whatever the NASDAQ is doing.

Alexia Tsotsis: Are you seeing down rounds because the NASDAQ is down?

Marc Andreessen: No, we have not seen down rounds yet. We have not seen down rounds yet, but consumer rounds that are happening now — consumer growth rounds are happening now at 2-4x lower prices than they were six months ago.

And the enterprise pricing is up a lot. Enterprise pricing a year ago was probably half what it is today. Maybe a third in some cases, and that made us happy at the time, but it’s all good.

Alexia Tsotsis: Last question — your top five enterprise cool kids?

Marc Andreessen: I think they are all on your list.

Alexia Tsotsis: They are on my list?

Marc Andreessen: Yeah, yeah.

CRUNCHBASE

- MARC ANDREESSEN

- ANDREESSEN HOROWITZ

Person:

Marc Andreessen

Website:

blog.pmarca.com

Companies:

Andreessen Horowitz, Ning, Facebook, Qik, Hewlett-Packard, Kno, Bump Technologies, eBay, Asana, CollabNet, Opsware, Netscape

Mr. Marc Andreessen is a co-founder and general partner of the venture capital firm, Andreessen Horowitz. He is also co-founder and chairman of Ning and an investor in several startups including Digg, Plazes, and Twitter. He is an active member of the blogging community. Previously, Andreessen developed Mosaic and co-founded Netscape. Mosaic was developed at National Center for Supercomputing Applications, on which Andreessen was the team-leader. Andreessen co-founded what later became Netscape Communications which produced the ‘Netscape Navigator’. Netscape Navigator…